How can the mobile financial ecosystem be secured on a “Mobile First” continent ?

Africa is today the beating heart of global Mobile Money. In a context where a large share of the population remains unbanked, the mobile phone has become the primary channel for accessing formal financial services.

- According to Ecofin Agency, in 2024, the African continent processed more than 1.1 trillion dollars in Mobile Money transactions, representing 65% of the total global value of these transactions.

- With 1.1 billion registered accounts and a growth of 19% in one year, Africa concentrates more than half of Mobile Money accounts worldwide.

- In Sub-Saharan Africa, 23% of adults saved on a Mobile Money account in 2024, a rate well above the global average.

This success is based on accessibility, ease of use, and the density of local agents, but above all on user trust, as these platforms are perceived as tangible alternatives to traditional banking services in rural and peri-urban areas, Tech Africa News & All Africa.

However, this rapid transformation raises a central, strategic, and systemic question:

How can a hyper-growing Mobile Money ecosystem be secured without slowing adoption or degrading the user experience?

Around this main question revolve other fundamental issues addressed in this article:

• Why has Africa become the global leader in Mobile Money?

• How is Mobile Money fraud different from traditional banking fraud?

• Why do traditional security mechanisms fail in this context?

• How are contextual anti-fraud and AI transforming user protection?

1.Africa, global leader in Mobile Money: a “Mobile First” market

The “State of the Industry Report on Mobile Money 2025” published by GSMA reveals impressive figures: 1.1 billion active accounts in Sub-Saharan Africa, representing 74% of global transactions carried out on the continent. In 2024, more than 81 billion operations were recorded, for a record financial volume of 1,100 billion dollars, up 22% in volume and 15% in value compared to 2023.

The same report shows that Africa represents a very significant share of the volume and value of mobile money transactions worldwide, well above 50% of the total.

The Global Findex 2025 report indicates that 40% of adults in Sub-Saharan Africa held a mobile money account in 2024, compared to 27% in 2021, representing the highest rate in the world. Overall financial inclusion reaches 58% of adults having an account (bank or mobile money), up from 49% in 2021.

This dominance of Mobile Money is not merely a technological phenomenon, but a banking paradigm shift. Where Europe digitized existing banks, Africa created a native mobile banking model, faster, more inclusive, but also more exposed.

Recommendation: Nexfing recommends considering Mobile Money not as a product, but as a critical system, requiring security standards equivalent to those of traditional core banking.

2.Rapidly growing Mobile Money fraud

2.1. An explosion of threats in 2024–2025

According to the Interpol African Cybercrime Report 2024, losses related to financial cybercrime in Africa now exceed 4 billion USD per year, a growing share of which is linked to Mobile Money.

Mobile Money specific frauds:

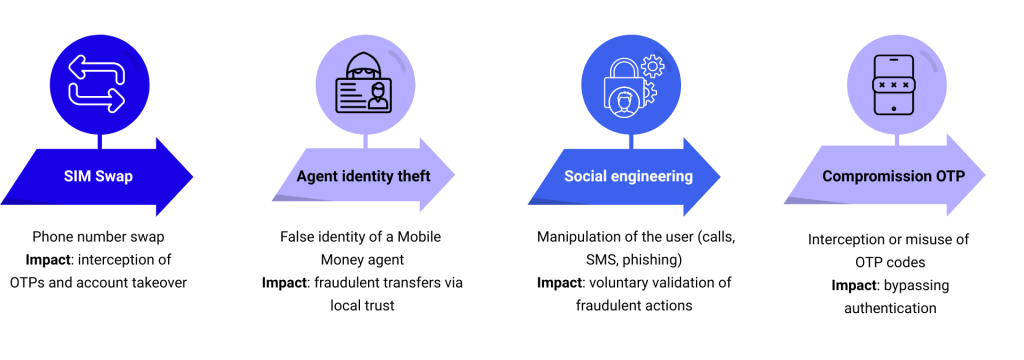

• SIM Swap : fraudsters reassign a phone number to another SIM to intercept OTPs and verification codes. In some African countries such as Kenya, this type of fraud has exploded, with investigations increasing by 327% in 2025, according to Scam WatchHQ.

• Agent identity theft: fraudsters pose as legitimate agents to transfer funds from user accounts.

• Social engineering : through fraudulent calls, phishing, or convincing pretexts, scammers incite users to reveal their credentials.

In some markets, e.g. Ghana, 20% of total financial fraud is directly linked to mobile money accounts, according to Tech Info Africa.

2.2. Fraud adapted to local usage

Unlike traditional banking fraud, Mobile Money fraud exploits:

• Dependence on the phone number as the primary identifier,

• Trust in local agents,

• And sometimes low digital maturity among users.

The figures clearly show one thing: Mobile Money fraud is behavioral before being technical. It adapts to local habits, schedules, and social practices. Rigid systems are therefore structurally ineffective.

Limit of fixed-rule systems :

Traditional approaches based on monetary thresholds or static rules do not take into account individual user behavior or the overall context of the action. This makes them predictable and easily bypassed by fraudsters who test and adapt their attacks.

3. Why traditional anti-fraud systems no longer work ?

3.1. The limits of fixed rules

Systems based on simple rules : maximum amounts, daily caps, blacklists, now show their limits:

• Easy to bypass

• Generators of false positives

• Degrade the user experience

• Poorly scalable against adaptive attacks

3.2. A mismatch with African realities

Rigid rules do not take into account:

• Geographic variations (rural vs urban areas),

• Local rhythms of life,

• Seasonal practices,

• Nor informal usages.

In an environment as dynamic as African Mobile Money, rigidity is a major operational risk. It provides weak protection and is costly in terms of adoption.

Recommendation: Nexfing recommends moving from a static control logic to a dynamic understanding of user behavior.

4. The Solution: Contextual Anti-Fraud, when AI becomes a strategic ally

Understanding context rather than isolating it :

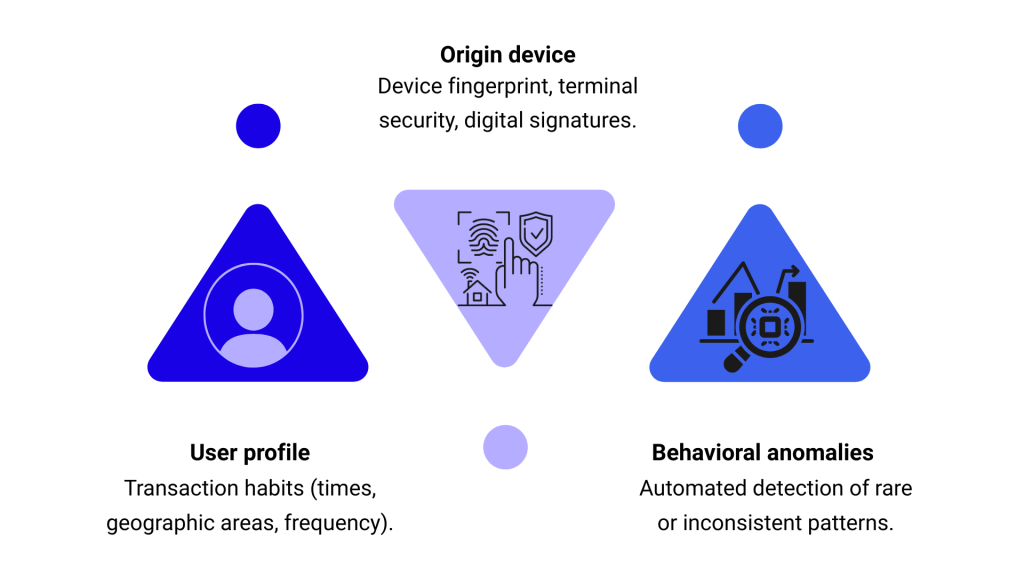

Contextual anti-fraud no longer focuses on the transaction itself. It analyzes the entire context in which it occurs:

Role of AI in anomaly detection :

Thanks to machine learning models, it becomes possible to :

• Generate normal behavior profiles for each user.

• Detect deviations at high speed that may indicate fraud.

• React in real time, blocking or alerting before funds are compromised.

Artificial intelligence continuously learns, adapts to new forms of fraud, and reduces false positives, thereby improving the user experience while strengthening security.

5. General strategic recommendations

• Invest in anti-fraud as a growth lever

Anti-fraud should no longer be seen as a defensive function or a simple cost center. In a Mobile Money ecosystem built on trust, the robustness of security mechanisms directly conditions adoption, retention, and the activation of new financial services. A mature anti-fraud strategy thus becomes a growth accelerator, securing existing uses while paving the way for higher value-added products.

• Favor contextual and adaptive models

Faced with heterogeneous and constantly evolving uses, rigid approaches quickly reach their limits. Contextual models, capable of adapting to real user behaviors and their environment, offer finer and more intelligent protection. This adaptability strengthens security without introducing unnecessary friction, reconciling operational efficiency and user experience.

• Localize security strategies

The realities of African Mobile Money vary significantly from one country to another, and even from one region to another. An effective security strategy must integrate these local specificities: usage practices, levels of digital maturity, regulatory constraints, and socio-economic dynamics. Localization of anti-fraud mechanisms is therefore not an option, but a condition for relevance and performance.

• Train agents and users

In a model highly dependent on the human factor, technological security cannot be dissociated from awareness among field actors. Agents and end users constitute the first line of defense against fraud. Investing in training and education significantly reduces risks, while strengthening trust and credibility within the ecosystem.

• Measure fraud as a strategic KPI

Fraud should not be monitored solely from the angle of financial losses. It must be integrated into strategic dashboards, alongside adoption, service availability, and customer satisfaction. Measuring, analyzing, and managing fraud as a KPI makes it possible to anticipate risks, adjust strategies, and embed security within a logic of overall performance.

6. Conclusion: Security as a growth lever

The fight against fraud in the Mobile Money ecosystem should not be perceived as an expense, but as a strategic investment. Robust security:

• Strengthens user trust, the cornerstone of any sustainable financial inclusion.

• Unlocks new financial services (credit, savings, insurance) thanks to an environment perceived as secure.

• Facilitates large-scale adoption, driven by speed, simplicity, and service reliability.

On a continent where mobile is the bank, contextual security is today the only bulwark capable of keeping pace with evolving usages and threats, and AI lies at the heart of this revolution.

What if fraud were no longer a risk, but a strategic opportunity?

In a rapidly expanding Mobile Money ecosystem, Nexfing supports you in transforming technological and regulatory complexity into a sustainable competitive advantage.

From audit to the implementation of contextual AI-driven anti-fraud solutions, you benefit from expertise tailored to African realities and international standards.

Contact Nexfing today to secure your platforms, strengthen user trust, and prepare the financial services of tomorrow.

Sources :

Ecofin Agency : https://www.ecofinagency.com/finance/0904-46604-mobile-money-transactions-in-africa-surge-15-in-2024-gsma

All Africa : https://allafrica.com/stories/202504160452.html

Tech Africa News : https://techafricanews.com/2025/04/10/1-1-billion-mobile-money-accounts-whats-driving-africas-mobile-money-revolution/

Scam watchHQ : https://www.scamwatchhq.com/kenya-scams-2025-m-pesas-dark-shadow-when-mobile-money-revolution-becomes-fraud-epidemic/

Interpol African CyberThreat Assessment Report 2025 : https://www.interpol.int/content/download/23094/file/INTERPOL_Africa_Cyberthreat_Assessment_Report_2025.pdf

Global Findex 2025 : https://openknowledge.worldbank.org/server/api/core/bitstreams/36a34d3f-a3c4-498b-ad24-558990c20806/content

La voix au centre : https://lavoixducentre.info/2025/04/19/afrique-leader-mondial-du-mobile-money-avec-11-milliards-de-comptes-et-74-des-transactions/

Tech Info Africa : https://techinfoafrica.com/2025/09/26/mobile-money-fraud-accounts-for-20-of-financial-fraud-cases-in-ghana/