Automating Banking Audit in Africa Without Slowing Innovation

In an African banking context undergoing rapid digitalization between modernization of channels, massive adoption of mobile banking, transition to the cloud, and the rise of fintech/neo-banks ensuring regulatory compliance and IT security while maintaining high operational agility is no longer an option, it is imperative.

The African continent is currently facing major cyber threats: the annual cost of cybercrime is estimated at USD 3.5 billion, according to African Footprint 2025. The INTERPOL Africa Cyberthreat Assessment 2024 report reveals that in 2023, the average number of weekly cyberattacks per organization increased by 23%, the highest growth in the world. At the same time, according to Africa News, about 90% of African companies operated without a proper cybersecurity protocol.

Financial systems are among the most frequent targets: the Africa Cybersecurity Report by Serianu estimates losses related to cybercrime at USD 10 billion for Africa in 2023, with USD 383 million for Kenya alone. These figures demonstrate the urgency of continuously monitoring critical systems: core banking, mobile money, digital channels, APIs.

This is where the paradigms of Continuous Compliance and DevSecOps (integration of security into the software development lifecycle) come into play, promising to reconcile compliance, security, and execution speed. The objective of this article is to demonstrate how to automate security controls and audits without burdening IT processes, showing that acting quickly and remaining compliant are perfectly compatible goals.

Several key questions arise: how can compliance and security be directly integrated into IT development and operational processes, making them “embedding by design”? What concrete benefits, in terms of costs, speed, and risk reduction, can compliance automation bring to an African banking actor? What technical best practices should be adopted to implement DevSecOps and Continuous Compliance in a multi-system environment combining core banking, APIs, cloud, and legacy systems? And finally, which cultural, technical, and organizational obstacles must be anticipated and how can they be effectively overcome?

1. Why Traditional Compliance Struggles to Keep Pace in the Banking Sector

1.1 Growing Complexity of Regulatory Requirements and Technological Risks

In recent years, regulators have imposed increasingly numerous and varied requirements: data protection, cybersecurity, anti-money laundering, payment supervision, transaction traceability, etc.

At the same time, African banks are modernizing their IT infrastructures: adoption of cloud solutions, microservices, open APIs, fintech integration, and digitalization of customer journeys. This convergence creates an environment where technological risks (data leaks, misconfigurations, uncontrolled access)

increase.

According to the PwC Global Compliance Survey 2025, 51% of companies identify technological risks (cybersecurity, data protection) as a priority. 77% note that compliance complexity negatively affects growth-driving areas. 85% consider that compliance requirements have increased over the last three years, a phenomenon particularly pronounced in financial services.

Consequently, periodic auditing becomes insufficient: ad-hoc reviews do not detect rapid deviations, documentary evidence is often scattered, and the compliance effort consumes significant resources, slowing innovation and delaying time-to-market.

1.2 Cost and Inefficiency of Manual Processes

Manual processes log collection, configuration reviews, code reviews, audit documentation are costly, prone to human errors, not very scalable, and often implemented in siloed contexts (development, security, compliance, operations).

In many organizations, compliance teams still rely on Excel sheets, ad-hoc audits, and human reviews, which not only introduce delays but can leave many vulnerabilities or non-compliances undetected until the next audit.

The traditional approach to compliance has shown its limits in a modern banking environment: the required responsiveness, granularity, and frequency exceed what periodic audits can guarantee. For an African actor undergoing digital transformation, this dissonance between speed and compliance can become a bottleneck.

Nexfing recommends considering compliance not as a one-time audit event, but as a continuous process, integrated into the application and IT operations lifecycle, to avoid delays, deviations, and regulatory risks.

2. The Shift to DevSecOps & Continuous Compliance: Market Status and Global Dynamics

2.1 Rapid Growth of the DevSecOps Market

The global DevSecOps market size was estimated at USD 8,841.8 million in 2024 and is projected to reach USD 20,243.9 million by 2030, growing at a CAGR of 13.2% from 2025 to 2030. This shift is driven by cloud-native architectures and accelerated deployment cycles.

Another OG Analysis study positions the global DevSecOps market at USD 10.4 billion in 2025, with a projection close to USD 70 billion by 2034, illustrating the significant growth potential.

By industry, the Banking / Financial Services & Insurance (BFSI) segment is largely leading or among the most dynamic, confirming that regulatory pressure and the sensitivity of banking data drive financial institutions to adopt these practices.

2.2 Rise of Automated Compliance: Continuous Compliance Automation

According to PwC 2025, 82% of companies plan to invest more in technologies to automate compliance activities, from risk assessment to transaction monitoring, due diligence, regulatory reporting, and continuous controls.

These tools increase risk visibility according to 64% of respondents, identify issues faster (53%), improve reporting

quality (48%), enable faster decision-making (46%), and generate productivity gains (43%).

The adoption of DevSecOps and Continuous Compliance Automation emerges as a structural trend, especially in banking and finance: on one hand, regulatory constraints and cyber threats push investment; on the other, competitiveness demands rapid delivery cycles.

Nexfing recommends leveraging this momentum by positioning automated compliance not as a cost or constraint, but as a lever of agility, resilience, and differentiation. Integrating DevSecOps & CCM from project conception is a forward-looking strategy.

3. Principles and Architecture of an Automated and Continuous Audit System

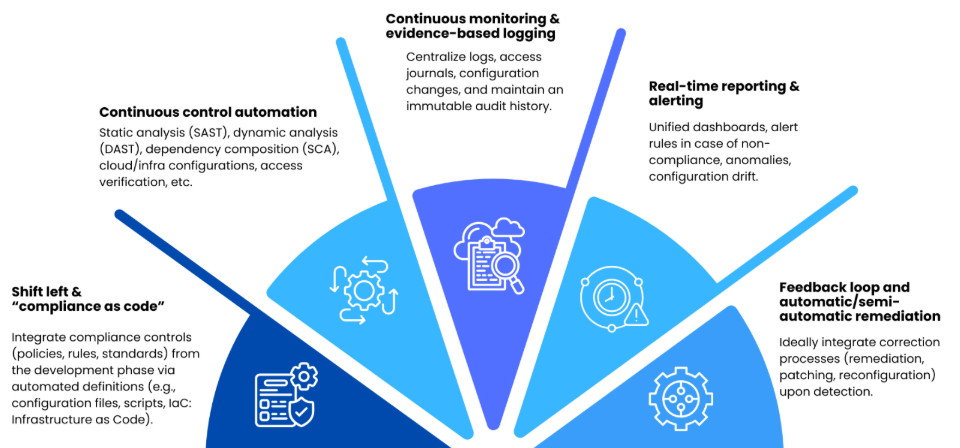

To automate audit and compliance without slowing IT cycles, several principles must be adopted:

This model enables an “always audit-ready” posture while maintaining rapid development cycles. This architecture embodies the balance between security, compliance, and agility. By adopting it, banking IT teams can significantly reduce deviation risks, shorten correction times, and ensure sustainable compliance.

Nexfing recommends implementing a modular DevSecOps + CCM pipeline: start with the most critical controls (code, infra, access), then progressively extend to advanced controls (runtime, cloud configuration, regulatory compliance). An incremental approach minimizes disruptions and facilitates team adoption.

4. Specificities and Challenges in an African Banking Context

4.1 Context-Specific Challenges

- Heterogeneous infrastructures and coexistence of legacy & modernization: many banks still use legacy systems (core banking, mainframes) while launching digital projects (mobile banking, APIs, cloud). Integrating DevSecOps + Continuous Compliance in such contexts requires managing hybrid environments with strong technical constraints.

- Limited resources and lack of specialized security skills: many institutions lack DevSecOps or GRC profiles, slowing adoption.

- Non-homogeneous local regulations: regulatory frameworks vary from country to country, complicating the definition of internal compliance standards, especially for banks operating across multiple jurisdictions.

- Budget and prioritization: compliance vs digital transformation. Banks invest in digital transformation, but compliance is sometimes seen as an expense rather than a strategic lever.

4.2 Risks if Not Adapted

- Delays in deploying innovations (mobile banking, APIs, fintech)

- Regulatory sanctions, fines, reputational risks in case of non-compliance or security breaches

- Loss of customer/investor trust

- Accumulation of technical debt and “GRC tech debt” difficult to address retrospectively

The African context imposes specific constraints: infrastructure heterogeneity, lack of skills, tight budgets, regulatory complexity. Yet it is precisely in these environments that DevSecOps + Continuous Compliance makes sense industrializingsecurity and compliance, making them scalable, and avoiding the accumulation of risks.

Nexfing recommends adopting a pragmatic, progressive approach: start with pilot projects (payment modules, APIs, digital services) to demonstrate value and ROI, then extend the approach across the IT system, combining automation, training, and governance.

5. Practical Recommendations (Governance, Processes, Tools, Culture)

Concrete operational recommendations for financial institution implementing DevSecOps & Continuous Compliance:

- Establish cross-functional governance “Dev–Sec–Compliance–Risk”: involve security, compliance, infrastructure, and development teams from the architecture stage. Ensure a policy repository (security, compliance, regulatory) is defined, versioned, auditable.

- Adopt “compliance as code”: translate regulatory and internal requirements into code (policies), version in Git, apply via CI/CD pipeline.

- Equip the CI/CD pipeline with automated tools: SAST, SCA, DAST/IAST, infra scans (IaC, containers, cloud), continuous configuration analysis.

- Centralize logs, events, scan results, and compliance evidence: use a GRC/CCM platform to aggregate, correlate, alert, generate reports.

- Automate remediation or quickly escalate tickets: when a control fails, trigger a correction process, monitoring, and retest.

- Train teams on awareness, shared responsibility, and DevSecOps culture: security and compliance are everyone’s responsibility, not a silo.

- Start with PoCs / pilot projects: to demonstrate ROI (vulnerability reduction, compliance timelines, audit costs, etc.) before scaling.

- Plan an evolution roadmap: start with code and infra, then extend to business processes, data, regulatory compliance (KYC, AML, data protection), cloud/hybrid environments.

6. How to Reconcile Compliance and Speed?

It is clear that compliance and technological execution speed are not antagonistic; they can coexist and even reinforce each other. By adopting a DevSecOps approach coupled with Continuous Compliance Automation, financial institutions including in Africa can ensure high security and compliance while continuing to innovate, rapidly deploy new digital services, and meet customer needs.

Compliance ceases to be a one-off constraint and becomes an integrated, automated, continuous, and evolving process.

How would you envision an agile, innovative banking infrastructure that is compliant without compromising speed or security?

At Nexfing, expertise covers consulting, custom development, AI & blockchain integration, and the implementation of DevSecOps pipelines adapted to African realities. The team can design a secure CI/CD architecture, define “compliance as code” policies, deploy a continuous compliance platform, and support your teams in upskilling.

Contact us to co-build a DevSecOps + Continuous Compliance system that combines agility, compliance, and resilience, positioning your institution as a trusted market player.